Power Price Volatility Returns

Unless you’re reading this on a beach in the Caribbean, you know we’ve experienced brutal cold weather over the past week across a majority of the US (with the worst yet to come for the east coast). In all 50 states, at least one place recorded a temperature below 32 degrees on Tuesday, and on New Year’s Day, temperatures across 90% of the US didn’t reach 32 degrees. With extreme cold, extreme demand for gas follows. In fact, the US burned the most gas ever on Monday (143 bcf), beating the last record set during the polar vortex in winter 2013/2014. While natural gas prices have only risen modestly due to strong production in shale regions such as Marcellus and Permian, day ahead hourly power pricing in NYC, Boston, and PJM has reached its highest level since February 2015. Read on for more insights into this power pricing volatility and what it means for your portfolio.

Download the EnergyWatch Electricity Markets Explained reports for NYSIO, PJM, and NEISO for an explanation of Locational Marginal Pricing and how prices are set.

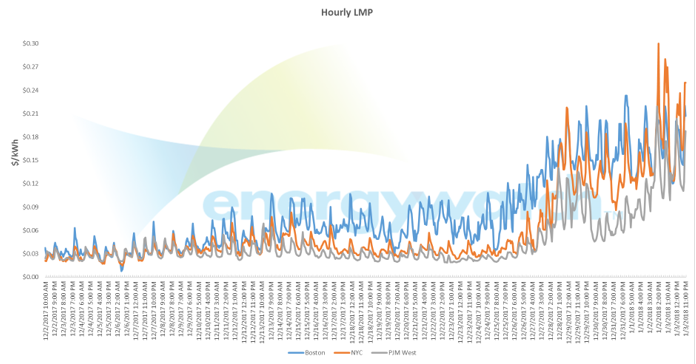

Day ahead hourly pricing (LMPs – locational marginal pricing) reached as high as $.30/kWh in NYC, $.23/kWh in Boston, and $.22/kWh at the benchmark PJM West hub during this latest cold snap.

Since 12/26, average hourly pricing is 2-3x higher vs. the prior 9-day period.

| Average LMPs $/kWh | ||

| 12/26/17 – 1/3/18 | 12/17/17-12/25/17 | |

| Boston | $0.1524 | $0.0661 |

| NYC | $0.1268 | $0.0341 |

| PJM West | $0.0841 | $0.0257 |

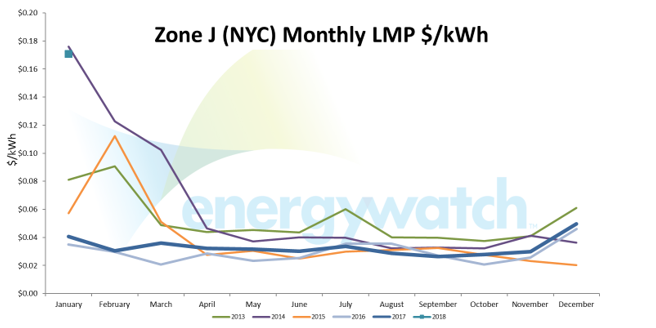

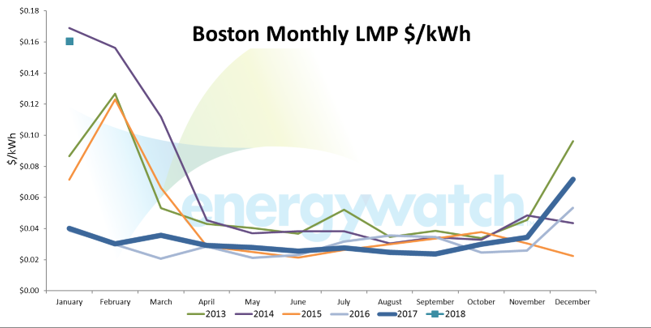

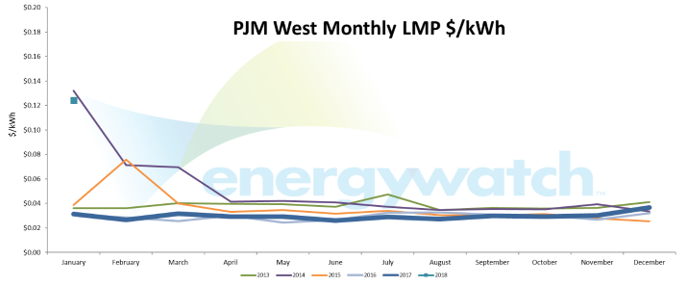

To put this in perspective, a full month hasn’t averaged higher than $.11/kWh in NYC and Boston or $.075/kWh at PJM West since February 2015. That’s not to say this pricing will continue through all of January, but an even colder blast of arctic air is expected this weekend.

What does this mean for my property?

If you’re receiving default hourly pricing from the utility company, are in a month-to-month variable contract, or are in an index contract without properly structured hedges, you will be subject to the hourly pricing volatility and your rate and cost will be higher vs. had you placed a partial hedge or fully locked your rate. The exact loss vs. these options depends on your consumption profile and location, but back of envelope, it’s about $25k-50k for every 500,000 kWh of consumption.